|

|||

|---|---|---|---|

|

|

|

|---|---|---|

|

||

|

|

|

|

|---|---|---|

|

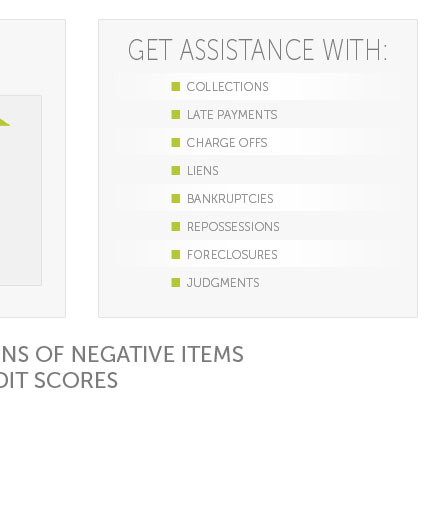

Unlock the power of financial freedom with our groundbreaking credit repair services, designed to catapult your credit score to new heights at lightning speed; no more endless waiting or frustrating setbacks-our expert team dives deep into personalized strategies, leveraging cutting-edge techniques and insider knowledge to erase inaccuracies, optimize your credit profile, and empower you with the tools to not just build, but truly transform your credit score faster than you ever imagined possible; it's time to take charge of your financial destiny with the confidence and ease you deserve.

https://www.careervillage.org/questions/918493/how-do-i-build-up-and-keep-a-good-credit-score

1. Planting Quality Seeds (Establishing Credit): Just as a healthy plant begins with quality seeds, a good credit score starts with wise credit ...

1. Planting Quality Seeds (Establishing Credit): Just as a healthy plant begins with quality seeds, a good credit score starts with wise credit ...

https://www.creditkarma.com/advice/i/quick-tips-build-credit

11 best ways to build credit - Check your credit reports on a regular basis to track your progress - Sign up for free credit monitoring - Figure ...

11 best ways to build credit - Check your credit reports on a regular basis to track your progress - Sign up for free credit monitoring - Figure ...

https://www.bankrate.com/credit-cards/bad-credit/how-to-build-credit-fast/

How fast can you build credit? - Make on-time payments. - Keep your credit card balances low. - Diversify your credit accounts.

How fast can you build credit? - Make on-time payments. - Keep your credit card balances low. - Diversify your credit accounts.